Table of Content

Capital gain can be applied for more than just real estate gains. It can also apply to a car, boat, or even rare piece of artwork that is sold for more than it was initially purchased. The difference between what you paid for an asset or property and what you sell it for is what the IRS uses to assess capital gains tax. The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate.

But using dividends to invest in underperforming assets will allow you avoid selling strong performers — and thus avoid capital gains that would come from that sale. The two years don’t need to be consecutive, but house-flippers should beware. If you sell a house that you didn’t live in for at least two years, the gains can be taxable. Selling in less than a year is especially expensive because you could be subject to the short-term capital gains tax, which is higher than long-term capital gains tax.

What Is the Capital Gains Tax?

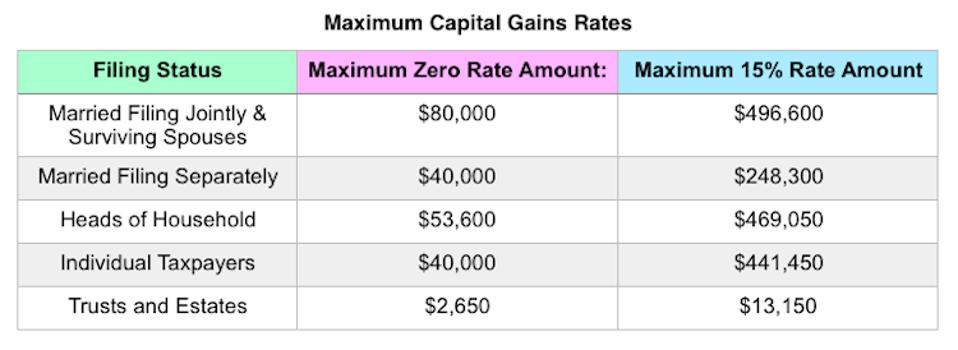

The rate of the capital gains tax will depend on the income bracket for that year. The cost basis of your home typically includes what you paid to purchase it, as well as the improvements you've made over the years. When your cost basis is higher, your exposure to the capital gains tax may be lower. Remodels, expansions, new windows, landscaping, fences, new driveways, air conditioning installs — they’re all examples of things that might cut your capital gains tax. For example, if you bought a home 10 years ago for $200,000 and sold it today for $800,000, you’d make $600,000. If you’re married and filing jointly, $500,000 of that gain might not be subject to the capital gains tax (but $100,000 of the gain could be).

However, if a property is solely used as an investment property, it does not qualify for the capital gains exclusion. By doing so, you can get rid of unwanted or unneeded assets and reinvest them in similar products. Your loss carryover is limited to the lower of $3,000 or the total amount of your loss.

Offset Capital Gains With Capital Losses

Some investors include tax-loss harvesting in their overall portfolio investment strategy to save money. Others say that it costs you more in the long run because you're selling assets that could appreciate in the future for a short-term tax break.. And if you repurchase the stock, you're essentially deferring your capital gains taxation to a later year. Critics of tax-loss harvesting also point out that since Congress can make changes to the tax code, you could also run the risk of paying high taxes when you sell your assets later. Capital gains and losses will either increase or decrease the value of your investment. But you only have to pay capital gains taxes after selling an investment – the money you make from an investment is subject to taxation at the federal and state levels.

Lily Wili, CEO of Ever Wallpaper says that “Short-term capital gains are usually not subject to a special tax rate. Instead, these earnings are often taxed at the same rate as your regular earnings. The rate you pay is determined by your income and filing status”. On the state level in New York, capital gains tax is taxed as ordinary income, dependent on the amount of income gained in a year and whether you are filing your return as a single taxpayer or married couple. Most capital gains taxes are imposed on the sale of homes located in New York.

Pay

Based on the notes to clauses amending the provisions of section 54, the intention of the legislature was to purchase the new residential property either before or after the date of sale of the original property. Such capital gain will be deemed to be the income of the previous year in which the transfer took place. You can use your tax-free allowance against the gains that would be charged at the highest rates (for example where you would pay 28% tax). Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct.

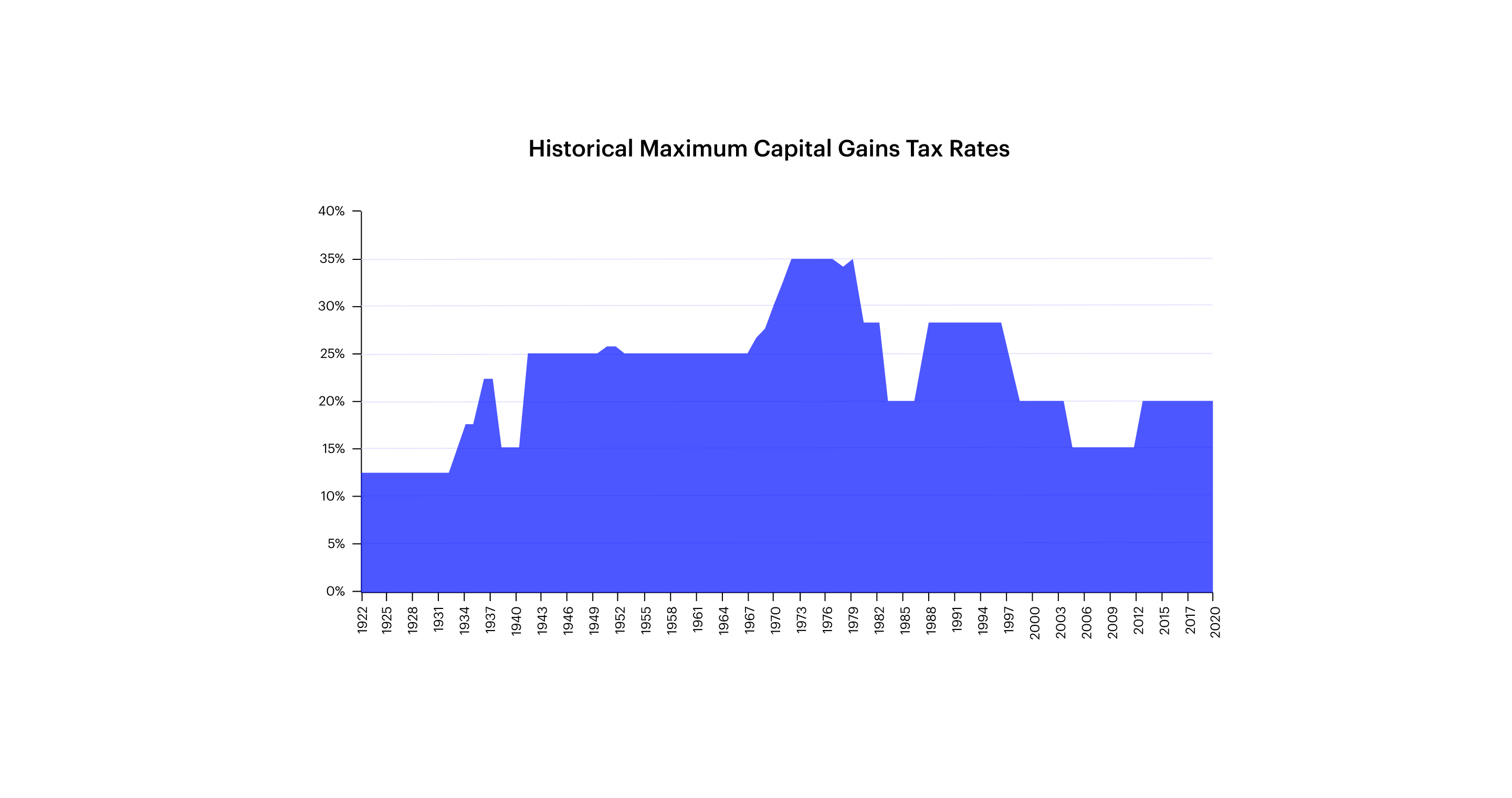

Second, there are a few places where the rate jumps — notably from 12% to 24% and then 24% to 32%. The IRS grants better tax benefits to those who sell a primary residence than investors who sell rental properties. It’s becoming commonplace for rental property owners to convert their investments into primary residences before carrying out the subject property’s sale. That way, they’ll be able to offset some of the capital gains taxes levied in their direction.

Popular Tax Links

As per section 2, long-term capital asset means a capital asset which is not a short-term capital asset. Treatment of capital gain tax on sale of Rural agricultural land in India i.e., agricultural land in India which is not situated in any specified area. As the year comes to a close, many taxpayers may start thinking ahead to filing taxes in 2023. One potential area where there could be an opportunity to save on your tax bill involves selling... Capital gains can increase your adjusted gross income, which can phase you out of itemized deductions, tax credits, Roth IRA eligibility and IRA contribution deductions. However, they do not push you into a higher tax bracket because they are taxed before your ordinary income.

The seller must have owned the home and used it as their principal residence for two out of the last five years . The main major restriction is that you can only benefit from this exemption once every two years. Therefore, if you have two homes and lived in each for at least two of the last five years, you won’t be able to sell both of them tax free until more than two years have passed since you sold the first one. In no way is any tax content contained herein to be construed as financial, investment, or legal advice or instruction.

For example, say you are bequeathed a house for which the original owner paid $50,000. The home was valued at $400,000 at the time of the original owner’s death. The taxable gain is $100,000 ($500,000 sales price - $400,000 cost basis).

It’s considered to be a personal loss, and a capital loss from the sale of your residence does not reduce your income subject to tax. For more information, consult a tax adviser or IRS Publication 523. Thankfully, in 1997, the Taxpayers Relief Act was introduced, and millions of residential taxpayers had the burden lifted. The lifetime option was replaced with the current sale of home exclusion amounts. This change makes it easier for homeowners to sell their current residence if they want to. Now that you have a better understanding of the capital gains tax for 2015, it's up to you to put this knowledge to work in order to maximize your income and minimize your tax liability.

You’ll pay 20% (or 28% on residential property) on any amount above the basic tax rate. You pay a different rate of tax on gains from residential property than you do on other assets. In some states, homes are cheap, property tax rates are less than half of 1% and the average property tax payment is just a few hundred bucks per year. The ordinary tax rates for 2022 taxable income filed in 2023 are listed below.

Almost everything owned and used for personal or investment purposes is a capital asset. If the above conditions are satisfied, the value adopted by the Stamp duty authority shall be taken as “full value of consideration” for the purpose of computation of capital gains. In other words, section 50C is applicable only in those cases, where stamp duty value is more than 110 per cent of actual consideration.

Use 1031 Exchanges to Avoid Taxes

Single people can exclude up to $250,000 of the gain, and married people filing a joint return can exclude up to $500,000 of the gain. First of all, you don’t pay capital gains tax on the full sale price of your property. Only the difference between your sale price and your original purchase price — also known as the “basis” or “cost basis” — is taxable. To defer capital gains trust, some taxpayers use a deferred sales trust. Under the tax rules, for installment sales, you only report your capital gain on the installment. Deferred sales trusts, however, have to be drafted carefully by a lawyer to ensure that it will be considered a deferred sales trust by IRS.

You have a capital gain if you sell the asset for more than your basis. You have a capital loss if you sell the asset for less than your basis. Losses from the sale of personal-use property, such as your home or car, are not deductible. If you bought that same table in 2022 and sold it the same year, you’d be taxed at the higher short-term capital gains rate. Capital gains are included in your taxable income, but they are not part of your ordinary income.

No comments:

Post a Comment